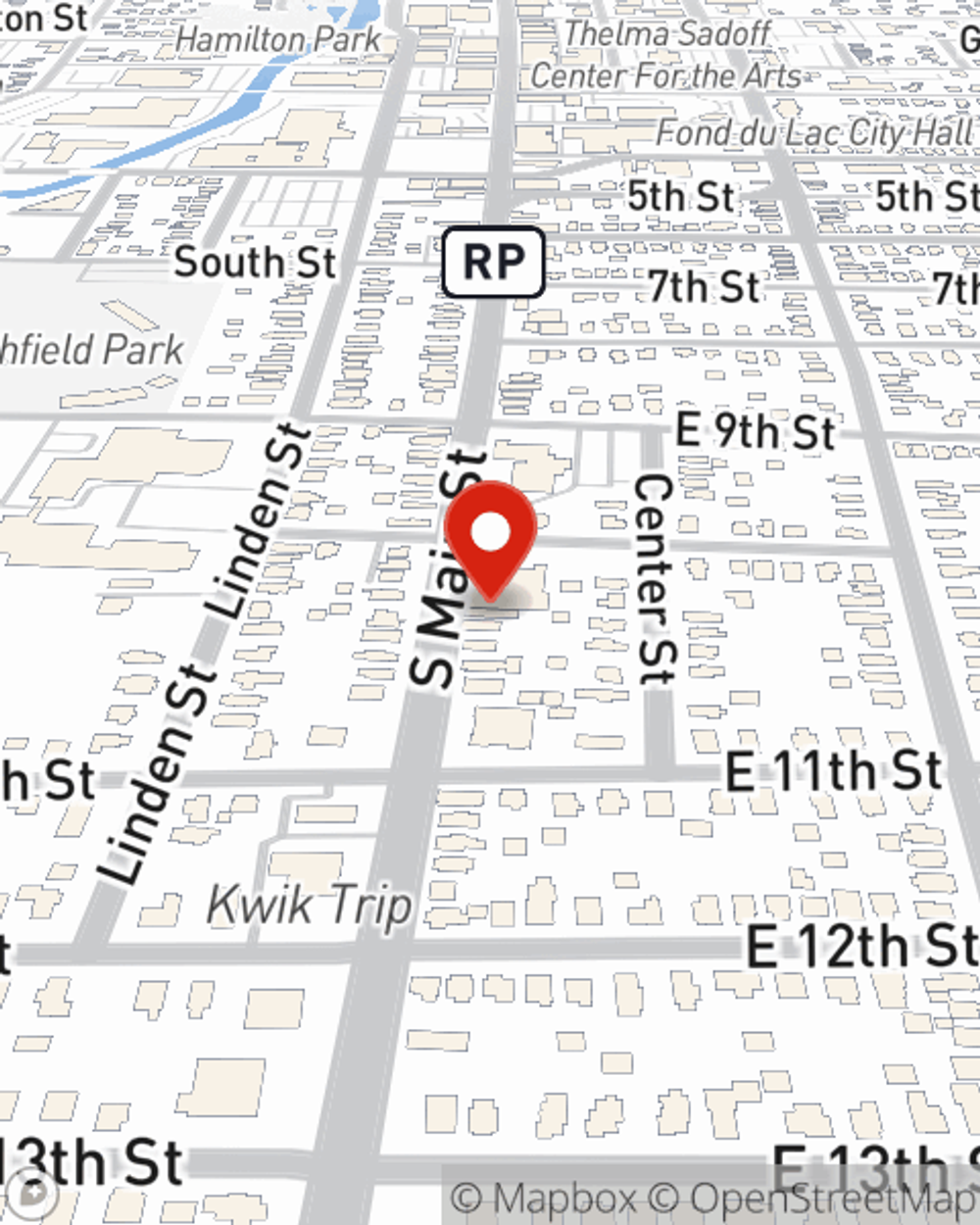

Business Insurance in and around Fond Du Lac

One of the top small business insurance companies in Fond Du Lac, and beyond.

Cover all the bases for your small business

- Fond Du Lac

- North Fond du Lac

- Malone

- Mount Calvary

- Eden

- Eldorado

- Campbellsport

- Van Dyne

- Rosendale

- Lomira

- Oshkosh

- St Peter

- Brownsville

- Two Rivers

- St Cloud

- Kiel

- New Holstien

- Manitowoc

- Wisconsin

- Dodge County

- Fond du Lac County

- Winnebago County

- Manitowoc County

Your Search For Remarkable Small Business Insurance Ends Now.

Do you own an architect business, a camping store or an antique store? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on your next steps.

One of the top small business insurance companies in Fond Du Lac, and beyond.

Cover all the bases for your small business

Protect Your Future With State Farm

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for surety and fidelity bonds, worker’s compensation or builders risk insurance.

Since 1935, State Farm has helped small businesses manage risk. Visit agent Bill Mahlik's team to discover the options specifically available to you!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Bill Mahlik

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.